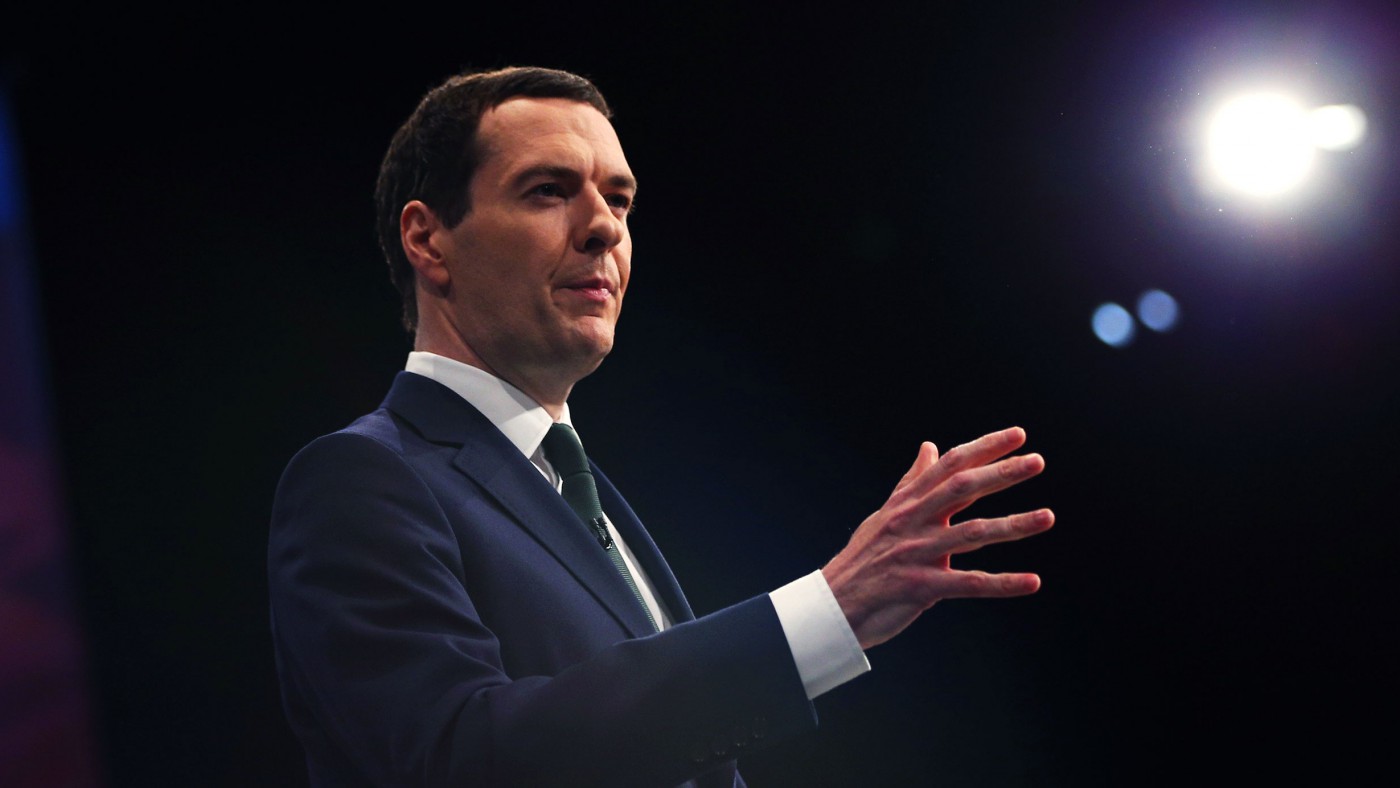

If a week is a long time in politics, three months is an eternity. In his budget in July, the Chancellor George Osborne announced that the Conservatives would introduce a so-called National Living Wage as a quid pro quo for slashing tax credits. He wanted to shift the UK, he said, from a ‘“high welfare, low pay” economy to a “low welfare, high pay” one. The Sun newspaper waxed lyrical. Tory MPs punched the air. A true ‘one nation’ budget, many claimed. Others outlined that this might be ‘bad economics’, but it was ‘good politics’ from the Chancellor.

Well, here we are. It’s now fair to say many Tory backbenchers are learning that bad economics eventually becomes bad politics too. For the truth is that whilst the government was right to highlight the need to reduce tax credit spending – which had expanded to a huge £30 billion, ensnaring 4.6 million families – the particular reforms offered up in that budget and the justification for them was simply misguided. That’s why today they find themselves on the defensive and with some of their own MPs, like Heidi Allen, passionately tearing into their own policy platform.

Tax credits are indeed a mess. They are complex, with arbitrary hours requirements encouraging many to remain in part time work. They have steep withdrawal rates meaning that, combined with taxes on income, people earning more face marginal tax rates as high as 73 per cent. A lack of clarity as to the aims of the credits (do they aim to give poor people money or encourage people to work?) mean the child tax credit comes with no work requirements at all, and for many part-time workers credits act as more of a wage substitute than a wage supplement.

There was a case then for starting again, and moving to something closer to the (much cheaper) US earned income tax credit – a system which incentivise full-time employment, whilst enjoying bipartisan support. But, instead, Osborne merely sought to save money within the existing framework. In turn, he will worsen the worst aspects of it.

Slashing the threshold above which tax credits are withdrawn from its current £6,420 a year to £3,850 and withdrawing credits more quickly will not only make many families financially worse off (some by as much as £1,000 a year), but also worsen the incentive for many to move into work or earn more.

This alone was bad economics. Given the government says it wants ‘full employment’, why do something that reduces labour supply? Yes, it’s difficult to save money without someone losing out, but worsening these incentive effects was not required. Yet more worryingly, this was justified with ridiculously muddled thinking.

The National Living Wage would make up for the cuts, it was said. But many of the beneficiaries of minimum wage rises (second earners, younger workers etc) would be different people from those affected by tax credit changes. And it wouldn’t fully compensate anyway, even if you assume away the negative effect on labour demand of raising the minimum wage.

It was also said it was necessary to do this, because ‘tax credits subsidise employers’. But there is little to no evidence for this. Hardly a public policy disaster.

Finally, it is said that this is absolutely necessary because the welfare bill must come down. But this week we learn that the generous triple-lock on the state pension is costing us £6 billion a year already. To govern is to choose.

It’s therefore good news that many Conservatives, commentators and The Sun newspaper are urging a rethink on these tax credit cuts. For some this will no doubt be due to pure electoral calculation. But for many who I’ve spoken to, they simply realise these changes are wrong. Better late than never.