With fundamentally important elections for Greece on the horizon, everyone from the Greeks to the Germans must work out where they stand on the issue of “Grexit” (the potential departure of Greece from the Eurozone). The subject has become a contentious issue once again, in light of indications from the polls that radical left wing party Syriza may well win the election and be unable to reach a compromise with the Troika (the European Commission, the European Central Bank, and the International Monetary Fund).

Background – The Greek Economy

Since late 2009, Greece has suffered from a depression comparable to 1930s America, resulting in widespread discontent and national suffering. Unemployment, now at just over 25%, has reached highs of 30%, with youth unemployment is shockingly above 50%. The country has the largest debt in the EU, measuring 177% of GDP, the servicing of which has been by far the largest drain on the economy. Compounding these issues were the ludicrously low retirement ages for public sector workers – civil servants employed before 1992 could retire on 80% of their final salary after 35 years’ service, if they had reached 58. A Greek workforce of approximately 2.7 million is, therefore, paying for approximately the same number of retirees. Clearly unsustainable, creditors have insisted that pensions be pared back.

This is just one of the austerity measures Greece has been struggling with. Germany, the main provider of Athens’ $240 billion worth of financing, has insisted upon unpopular reforms, especially to the pensions and public sector system. This has resulted in almost universal consternation in Greece, hence the desire for change – even if ill-advised.

The Election

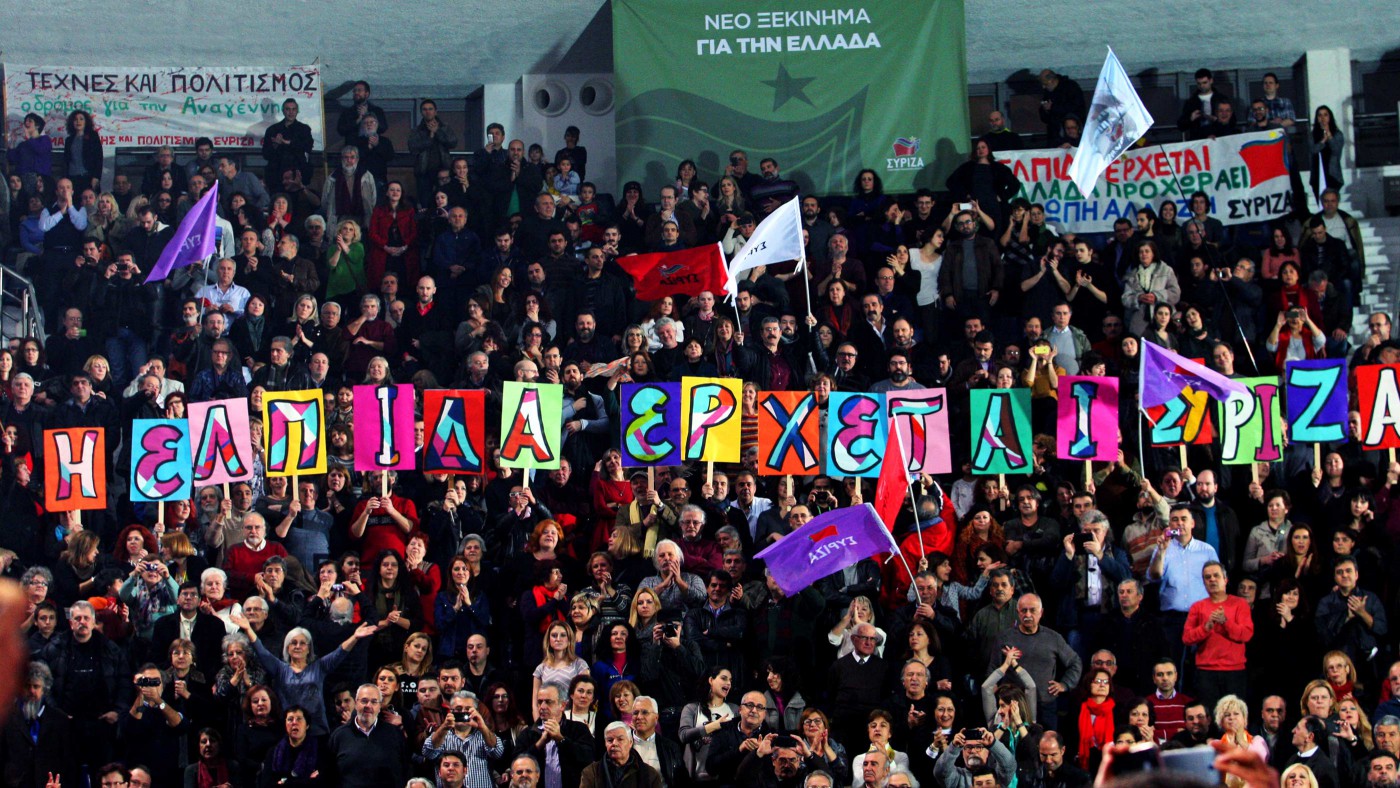

Since the Greek Parliament failed to elect a new president at the end of December, the parliament was dissolved and a snap election called for 25th January. Recently, the radical left wing party Syriza, under Alexis Tsipras has taken a 3-5% lead in the polls.

Greek Prime Minister Antonis Samaras warned on January 2nd that a victory for Syriza would inevitably equal a default and exit from the Eurozone, but Tsipras has denied such a claim, telling Greek weekly Realnews that “It’s clear from any point of view that the subject of Greece leaving the euro simply does not exist.” Alongside a poll last week that found that 74% of Greeks want to remain in the single currency, it seems that there is no real appetite to leave the Eurozone.

Despite this, Germany has been accused of trying to covertly influence the results of the election by reporting that Merkel is prepared to accept Greek exit if Syriza win. Under Greek law, however, despite the winning party gaining a fifty seat bonus, it is unlikely Syriza will gain an outright majority.

The election will be set against the background of an ECB meeting on the 22nd of January, which is likely to announce a quantitative easing program, involving the purchase of sovereign bonds, which will strengthen stability in the euro area and combat deflationary risks.

What next?

If Syriza are victorious, there will undoubtedly be anxiety regarding their ability and willingness to negotiate with Europe and vice versa. However, despite Syriza’s flirtation with the idea of Grexit in 2012, it has since adopted a more centrist stance, with John Milios, Chief Economist of Syriza, claiming that “everything we will do is in the context of staying in the Eurozone.” They now favour renegotiation with Euro partners that would relax austerity policies and ease debt terms. But how much would Germany be willing to concede?

The Greek bailout program with the Troika expires on February 28th, giving the new government less than a month to finalise a new economic plan. In the face of the unknown, it seems likely that both sides will be willing to compromise. Germany might have dismissed the possibility of more debt relief, but historically restructuring seems likely – Germany’s own debt, was after all largely wiped out in 1953. Any exit from the Eurozone, most commentators seem to agree, would be unintentional, in the event of an agreement not being reached.

If Greece were, however, to leave the euro, the general consensus is that the Euro zone might survive – just. According to JP Morgan, a Greek exit would see the euro fall to 1.05 against the dollar, resulting in significant costs and volatility in trade with the US and China, but Europe would be structurally sound enough to withstand Grexit since safeguards were implemented in 2012, such as the European Stability Mechanism (ESM), which means that Greece has less leverage in threats to leave. Greece might also be able to recover from a European exit since the government runs a primary surplus – if the debt was wiped, which would happen in the event of Grexit, the country would immediately be better off because taxes exceed government spending.

Fredrik Erixon, Director of the European Centre for International Economy in Brussels, told Bloomberg that “many officials believe a Greek exit would be manageable, and in contrast to 2010-2011, we wouldn’t see the same cascading effect on countries like Spain or Ireland”.

Even so, the real concern regarding Grexit would still be the risk of contagion. Although Germany would hope that Greek pain or forcible ejection from the Eurozone would put other countries off from following suit, if Greece was seen to be doing well after a couple of years, it’s possible that Italy or Spain, where the rise of leftist parties such as Podemos has been a threat, would attempt the same.

Generally, the potential results of Grexit are too unknown and risky to be in any elected politicians’ best interests. Nobody – not Syriza, the Greeks, Germany or the European Union – actively wants Greece to leave the Euro. In theory, therefore, it should be entirely possible to broker a compromise and avoid a breakdown of the common currency.